Many people think banking sector stocks are a safe bet because they pay strong dividends.

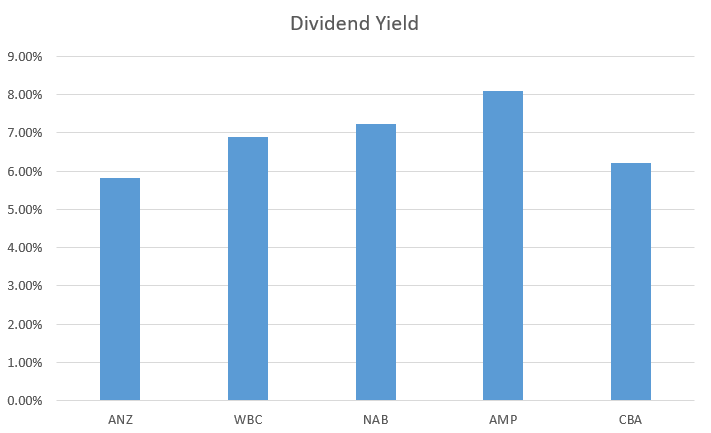

To a degree this is right. AMP, Commonwealth Bank, Westpac, NAB and ANZ all pay out healthy dividends.

It has traditionally been seen as a strong ‘income investing’ strategy.

As you can see, the dividend yield across the board is strong:

|

Source: marketindex.com.au |

But storm clouds have been gathering for some time now.

The royal commission puts pressure on the big banks’ share price

There are two primary factors at play.

The royal commission and the prospect of a credit crunch.

First and foremost, the royal commission has been doing a serious number on the stock prices of these five companies.

Below is a chart of the stock prices of these five companies since the establishment of the royal commission on 14 December 2017:

|

Source: tradingview.com |

As you can see AMP has taken the biggest beating, hitting a 15-year low.

They were recently caught charging dead people for life insurance. [openx slug=inpost]

The Big Four have not been immune either, with Westpac Banking Corporation [ASX:WBC] faring the worst after raising their variable home loan rate by a 14 basis points.

They did this ‘out of cycle’ to improve profit margins.

Last Thursday, Commonwealth Bank and ANZ responded with the announcement of rate hikes of 15 and 16 basis points respectively.

Looming credit crunch threatens bank profits

The big story from this Westpac move is that it could signal the early stages of a credit crunch.

A credit crunch is when investment capital becomes hard to secure.

Banks become fearful of making loans because of bankruptcies and defaults. A credit crunch frequently coincides with a recession.

Spurring this looming credit crunch is the conversion of $360 billion in interest-only loans which are set to mature in the next three years.

According to Professor Richard Holden, ‘…a whole chunk of people aren’t going to be able to pay’.

This is because variable interest rates are likely to increase during a time where the housing market is falling.

The big banks’ profit margins would suffer a significant hit in this scenario. The same goes for their share price.

As a result of these two factors, now does not look like the right time to be buying banking sector stocks.

If anything, investors may opt to sell to try and prevent further losses.

Regards,

Ryan Clarkson-Ledward