I’m thinking to buy another property. Prices are down. It’s a buyer’s market. And, for once, interest rates are looking almost European.

The bank is offering 3.79% on a 1-year fixed. Still not that enticing.

As margin lending on shares, I can pull out NZD at around 2% p.a. on the global money markets. Tempting.

But I’m still unconvinced Auckland has found the floor in the current environment. Nor do I believe for a moment that the recent slash to the OCR will change that.

Auckland is still expensive

Let’s go shopping!

Auckland is a pretty lifestyle city on a stunning harbour. As of June 2017, it had about 1.66 million people. Average annual temperature runs above 15°C.

In 2008, median earnings were $39,884 in Auckland. They’ve increased almost 50% to $59,488 in 2019.

But median house prices have increased some 85%. From around $450,000 in 2008 to $830,000 as of June 2019.

For prices to increase much faster than incomes, you need some external dynamics. Either increased debt levels. Or significant infusion of outside money from migrant and foreign buyers.

Both those dynamics were left to run riot while preceding governments stoked GDP growth.

So I’m looking at rental property again. As an investor, I’m still not sure the Auckland 2.4% median price fall in June provides enough discount or margin of safety.

As readers have pointed out in the property investment v. shares debate, property is tangible. You can go live there. Or provide the roof to your kids for a leg up when they come of age.

But gross rental yields of only around 4% in Auckland become net yields closer to zero when you factor in all costs and your time.

And Auckland sits within an infant volcanic field.

In 2002, the Auckland Regional Council suggested there was a 5% chance of an event within 50 years in this field.

So on the back of an envelope — to match the dividends I could potentially get from shares — I may need an additional 4% discount on price and another 5-10% on capital risk.

Could Auckland prices fall another 14%? To a target median price of around $700k?

Don’t think so. There remains a housing shortage here. But if some of the reductions in net migration suggested by NZ First and Labour become more active policy — alongside ramping up of housing supply — we could see it happen during a recession.

But Auckland is still comparatively expensive…

So, my son — these days — has his sights set on becoming an airline pilot.

I’d love him to own his own home on the sparkling North Shore.

But at a median price of 830k across Auckland, would that be his best choice?

Median commercial pilot salary in NZ is around 60k. So to buy a median home in Auckland — that’s 13.8 times earnings before we deduct tax.

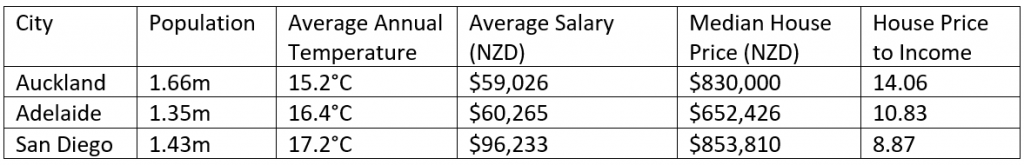

By population, two relatively-similar lifestyle cities nearby are Adelaide and San Diego.

Here’s a comparison by numbers (approx.):

Granted, all these cities are expensive. But I don’t see why Auckland should command nearly a 60% premium on San Diego by income multiple? Maybe I would pay 30% more to avoid Adelaide.

For the sake of my pilot-interested son, all three cities have international airports. San Diego served over 24m passengers in 2018. Auckland over 21m. Adelaide around 8m.

Sure, you’d need to do a lot more analysis to fully compare these towns. But as Ben Graham once said, ‘You don’t have to know a man’s exact weight to know that he’s fat.’

And Auckland is still looking a bit fat.

Where to invest?

Not sure there’ll be much capital gain left in Auckland in the short- to medium-run. And the prospect of managing another property fills me with experienced dread.

Right now, yields on a lot of Auckland property could make it a struggle. Especially against the average yield on the NZX. Not the highest-yielding stock exchange out there. But still spinning off a comfortable 4.54% on gross dividends alone.

Commercial and industrial property might be more promising. But you may need a higher entry price. And the ability to handle vacancy risk.

So what about property-based shares?

As I write, my shareholding in Property for Industry [NZX:PFI] is up nearly 40% since I commenced buying in 2017. And the dividend yield still exceeds anything the bank will provide. Or, for that matter, many Auckland rental properties.

Perhaps its price is also a little rich for now? Alongside Auckland’s.

And there are risks, of course. Dividends can get cut. Business strategies may not pan out. You also need your margin of safety.

But a recently-spooked stock market could see more opportunities on the NZX. Also further afield, especially in the UK, where everything seems to be on sale thanks to the ‘Brexit discount’. Maybe things there are over-discounted? Guess we’ll see this October.

I’ll be exploring the best yield and growth opportunities we can find — including property-based — in our premium newsletter, Lifetime Wealth Investor. Join us here for those.

When it comes to investing, there are two different camps — shares v. property.

Both have their loyalists.

And in both cases, it comes down to finding value. Hard work in this town…

Regards,

Simon Angelo

Editor, WealthMorning.com

Simon is the Chief Executive Officer and Publisher at Wealth Morning. He has been investing in the markets since he was 17. He recently spent a couple of years working in the hedge-fund industry in Europe. Before this, he owned an award-winning professional-services business and online-learning company in Auckland for 20 years. He has completed the Certificate in Discretionary Investment Management from the Personal Finance Society (UK), has written a bestselling book, and manages global share portfolios.