All that glitters is not gold.

—Ancient proverb

Are you a goldbug?

Well, if you are, I’m willing to bet that you’re passionate about the precious metal.

You keep buying it. You keep hoarding it. You believe it’s the ideal asset class to hold on to.

You certainly wouldn’t be alone in your conviction. There are many others like you, and I’ve heard my fair share of comments from them over the years.

‘Gold is the Noah’s Ark of wealth.’

‘Gold is the best hedge against inflation.’

‘Gold is the only honest money left.’

Yes, these are very persuasive ideas. And on an emotional level, I totally understand where they’re coming from.

Goldbugs are looking for peace of mind. They want a safe haven, especially if they believe that a financial apocalypse is about to happen.

They hate volatility. They crave stability. Therefore, gold is the best choice for them.

It can’t go wrong.

Or can it?

Well, lately, some popular assumptions about gold have been challenged.

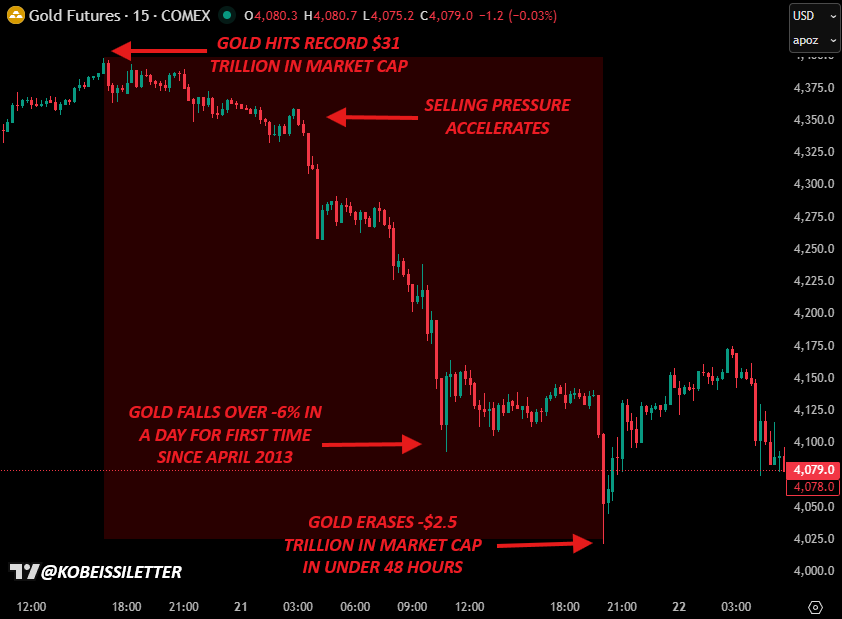

Just take a look at what happened in October…

Source: The Kobeissi Letter / X

Oh boy. You might call this a turning point. Here’s how the drama played out:

- On October 21, the price of gold peaked, hitting an all-time high of almost USD $4,400 per ounce. It seemed invincible. Unstoppable.

- In that moment, investors were feeling victorious. They were popping champagne. They were talking about eternal safe havens and fiat currency Armageddon. They were confident they had made the right bet.

- And then? Boom. October 22 delivered a gut punch. What we saw was the biggest single-day plunge in gold in over a decade. Gold eventually fell to around $4,080.

- Hearts raced. Portfolios bled. Investors were left shaken. They had no choice but switch their strategy. They started talking about ‘healthy corrections’ and ‘buying the dip’.

Now, as I write this, gold has climbed back over $4,100. It appears to be holding its support level.

- However, the recent surge of volatility is unnerving. It feels like the kind of trading that you would usually see in a digital asset like Bitcoin or Ethereum. A sudden fluctuation from euphoria to depression. In a blink.

- This is why it’s so confusing, isn’t it? Gold is not supposed to behave like this. It’s meant to act as a hedge against fear, not to cause it. And yet…incredibly enough…here we are.

This event is sobering. And it does raise some serious questions:

- Are we actually facing a speculative period for gold? And if so, will we see more wild price swings to come? What does the future look like?

- Well, I want to separate fact from myth. Here are 4 Urgent Signals to watch very closely, for the sake of everyone’s peace of mind…

Your first Quantum Wealth Report is waiting for you:

⚡🌎 Start Your Subscription: NZ$37.00 / monthly

⚡🌎 Start Your Subscription: US$24.00 / monthly

John is the Chief Investment Officer at Wealth Morning. His responsibilities include trading, client service, and compliance. He is an experienced investor and portfolio manager, trading both on his own account and assisting with high net-worth clients. In addition to contributing financial and geopolitical articles to this site, John is a bestselling author in his own right. His international thrillers have appeared on the USA Today and Amazon bestseller lists.