We’re living through a cost of living crisis, which means more of us are focusing on money matters than ever before. We want to know what we have coming in, what we have going out and how to best manage our finances in order to remain financially stable and secure. With wages remaining stagnant and the cost of everything from housing to energy to fuel going up, there’s no better time to really focus on managing your money professionally and responsibly. Here’s some information on how you can achieve this.

Have a Clear Budget

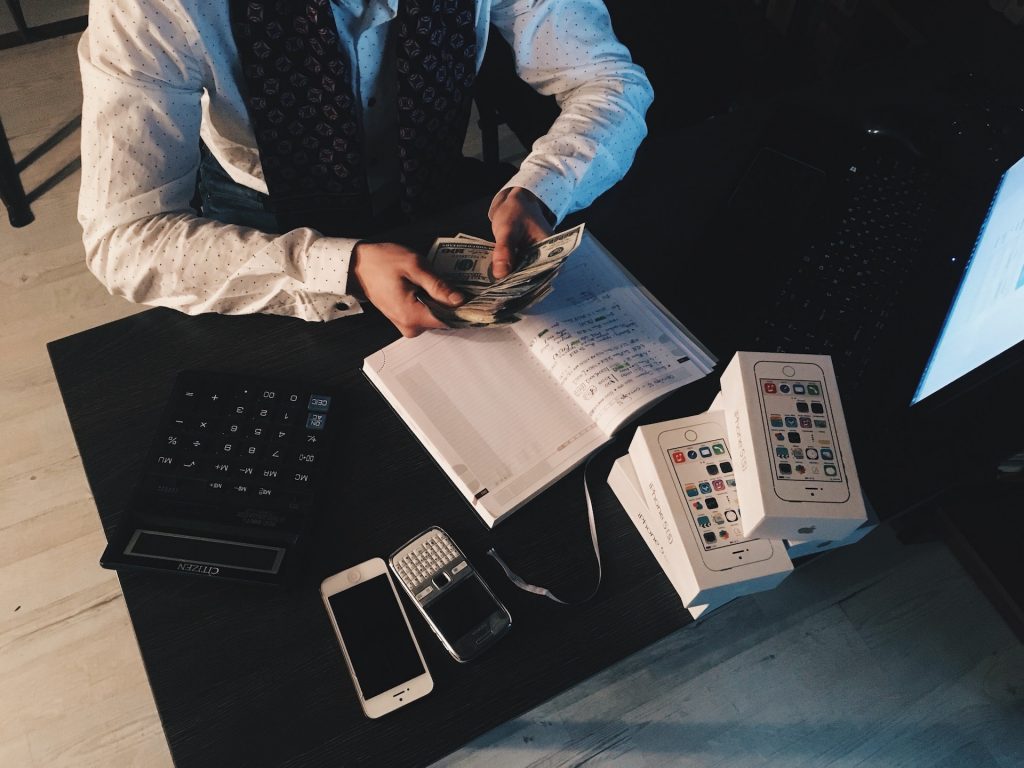

The first step to clever money management is to make sure that you have a very clear budget laid out for yourself. All too many of us simply spend what we want when we want and can quickly find costs spiralling out of control. Now is a time that you really don’t want to fall into debt and a budget can help you to avoid this. Start by considering your income. How much do you take home each month after tax and other essential contributions? Then, total up all of your ongoing bills and financial commitments. This can include rent or mortgage payments, food shopping, energy bills, car bills, contracted loan or debt payments and more. Deduct this figure from your take home pay and you’ll be left with your monthly disposable income. This is the amount that you can spend each month without falling into debt. Take a note of this and make sure to not exceed it.

Use an Accountant

Using an accountant can make all the difference to money management, especially if you run your own business or are self employed. This professional will know all of the ins and outs of the tax system you’re working within and will be able to make sure that you pay the right amount in tax at the fiscal year, ensuring you save any money you can on expenses and other acceptable tax reductions. Failing to use an accountant can result in miscalculations and either overpayment, which is negative for you, or underpayment, in which case you may need to seek the services of a Criminal Defense Attorney to get you out of a stick legal situation.

Consult a Wealth Manager

If you are in a position where you have a fair amount of disposable income, or you own assets that are worth a fair amount, you can really benefit from the services of a wealth manager. These professionals will be able to help you determine where you should be putting your money for the best long term gains. This could be investing or it could be placing money in savings. They will understand everything from the best interest rates available right now to the stability of different areas and chance of return on anything you’re considering investing in. This is a wise way to grow your money, but you should also be aware that investment comes with risk and you may lose money in the process.

Hopefully, some of these top tips will help you to manage your money as best as possible during these more difficult times!