The year was 1815, and Europe was on a knife’s edge.

You could taste the fear in the air.

The Duke of Wellington was going up against Napoleon.

The Battle of Waterloo.

The fate of civilisation itself hung in the balance.

Source: Julian Fellowes’s Belgravia

You have to remember:

- These were the days before the internet. Before the telephone. Before the telegraph.

- Breaking news was impossible to obtain. So people mostly relied on rumour and gossip. This fuelled speculation on the London Stock Exchange, creating volatility as prices of assets surged and ebbed.

- Who had won the battle? Who had lost? Would this create a power shift in Europe?

There were a lot of question marks. The anxiety was nail-biting:

- Nathan Mayer Rothschild — the famous Baron Rothschild — was an investor watching the markets.

- But he ignored rumour and gossip. He had done his research better than most. He had already prepared a network of messengers ahead of time — ready to deliver updates to him through an efficient relay of boats, horses, and even courier pigeons.

How effective was the Baron’s strategy? Well, consider this:

- The Battle of Waterloo concluded on Sunday, 18th June.

- By Monday, the Baron had received news of the Duke of Wellington’s victory.

- In comparison, the British government at Whitehall only received official confirmation on Wednesday.

This time gap was critical:

- While fear reigned in the markets, the Baron decided to act.

- He went on a buying spree. Scooping up valuable assets at a considerable discount.

It was a risk, yes, but the Baron felt it was a calculated risk:

- ‘Buy when there’s blood in the streets, even if the blood is your own.’

As a result, the Baron doubled the wealth of the Rothschild family in a matter of months:

- Hindsight, as they say, is 20/20.

- Right person. Right place. Right time.

Fear events can present a unique opportunity

We tend to think of investors like the Baron Rothschild as being exceptional. Maybe even an anomaly. And there’s no way that regular folks like us can match what he did. Or…can we?

- In reality, we can all learn something from the Baron’s foresight and discipline.

- He was prepared to do his own research.

- He was prepared to develop his own conviction.

- He was prepared to depart from the herd.

Here’s the important thing to understand: human nature never changes. The same instincts that sparked fear over 200 years ago are still the same instincts that we see today:

- People hate uncertainty, and they react on impulse.

- This is especially true when it comes to macroeconomic disruption. This fear can be oversold — by the media, by pundits, by hearsay.

- The result? The prices of good assets are temporarily pushed down by anxiety. This may present eagle-eyed investors with a unique opportunity.

Just ask my colleague Simon Angelo:

- In 2016, he was working at a trading desk in the UK.

- That’s when he witnessed a historic moment: the results of the Brexit vote being released.

- It was, quite literally, a shock to the system. The markets lurched in terror. Asset prices plunged. Many people were caught up in the tumult, believing that the nation was finished.

Source: Dezeen

The end of the UK. Really? Really? More rational minds would have considered this:

- The UK is the sixth-largest economy in the world.

- The UK is the third-largest recipient of foreign direct investment.

- Its capital, London, is the second-largest financial centre globally.

- The UK is, in fact, a superpower in its own right.

- Its special relationship with America remains undiminished.

- Its special relationship with the rest of the Commonwealth remains undiminished.

So, does leaving the compliance-heavy European Union automatically spell the end of the UK? Or is a fresh chapter unfolding as the UK recalibrates and reinvents itself?

- In retrospect, the answer — like the aftermath of Battle of Waterloo — is pretty obvious.

- If you have conviction and courage, you will come to see these moments of disruption differently. They are not obstacles to agonise over, but possibilities to embrace. A chance for you to acquire great assets at bargain prices.

A case to be made for carefully buying the dip

Are you still in doubt? Are you looking for more evidence? Well, here’s some compelling data to consider:

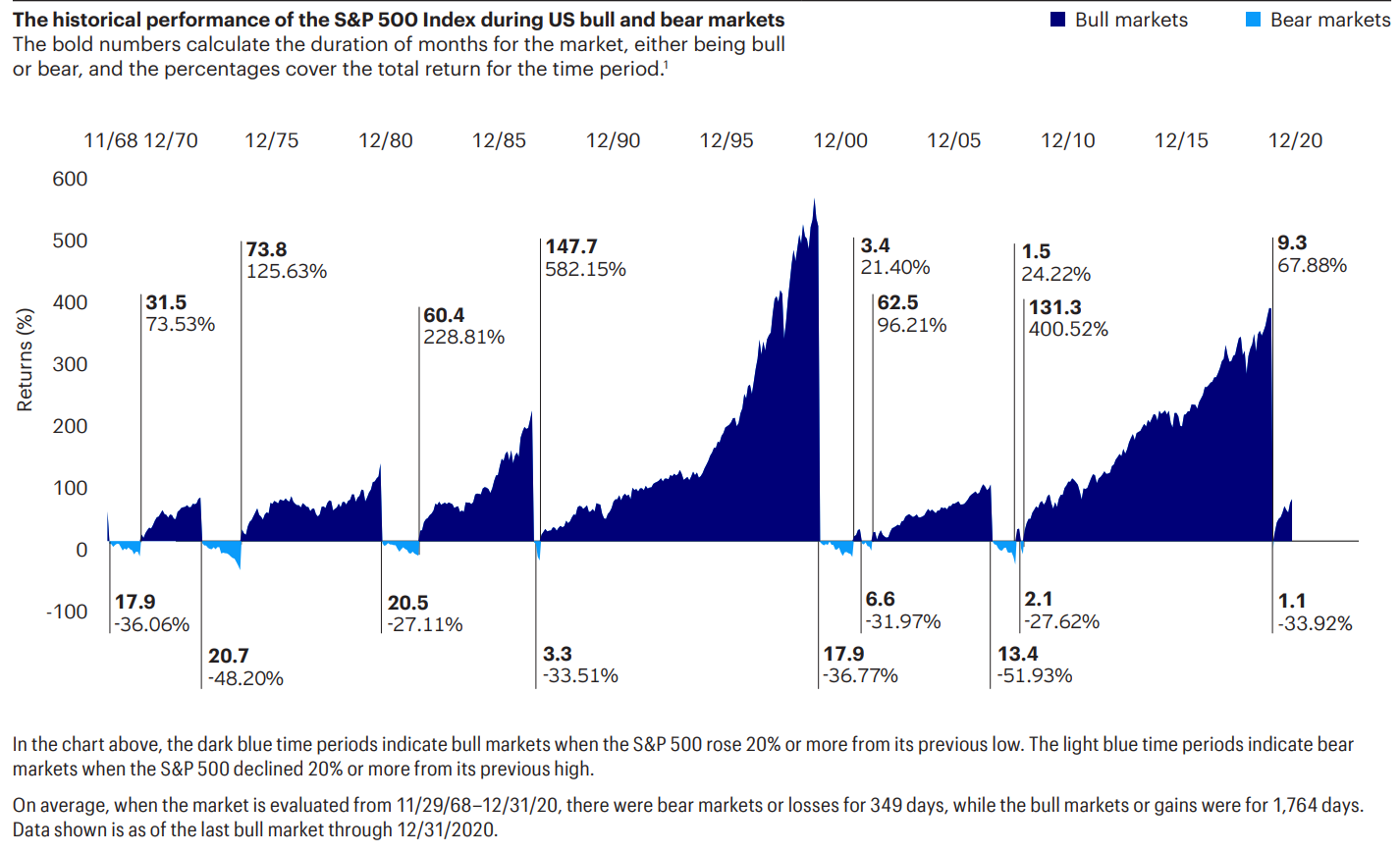

- Invesco, an investment-management firm, has done historical research on the S&P 500 Index.

- They looked at how it has performed over a 52-year period. In particular, how it fares when there are sharp movements of 20% or more.

What they discovered is fascinating. Here’s a snapshot:

- Bull markets (exceptionally happy periods) have lasted 1,764 days.

- Bear markets (exceptionally sad periods) have lasted 349 days.

- This means there have been five times more bull markets than bear markets.

- There are more happy days than sad days.

Source: Invesco

These numbers suggest that the markets have been remarkably robust and healthy in the long-term — overcoming all the short-term pain and tears that we’ve seen over the generations:

- Of course, past performance is never a guarantee of the future. And as human beings, it’s natural to be fearful. To be pessimistic.

- But if you can look past all that, you might just gain a worthy reward.

So, when exactly do you buy the dip? How do you buy the dip? This requires careful consideration:

- In our Quantum Wealth Report, we are constantly searching for value.

- To date, we have investigated and exposed over 100 hidden ideas. From property to energy; from artificial intelligence to cryptocurrency; we are doing a deep dive into the latest quantum trends.

- Ask yourself: are you concerned about your family’s well-being and happiness?

- Well, if you are, this is the best time to act. And this is the best place to start.

Your first Quantum Wealth Report is waiting for you:

⚡🌎 Start Your Subscription: NZ$37.00 / monthly

⚡🌎 Start Your Subscription: US$24.00 / monthly

✅ EXCLUSIVE BONUS: You’ll also receive an extra eBook report,

covering 13 NZX stocks, plus 1 global opportunity:

Regards,

John Ling

Analyst, Wealth Morning

(This article is general in nature and should not be construed as any financial or investment advice. To obtain guidance for your specific situation, please seek independent financial advice.)

John is the Chief Investment Officer at Wealth Morning. His responsibilities include trading, client service, and compliance. He is an experienced investor and portfolio manager, trading both on his own account and assisting with high net-worth clients. In addition to contributing financial and geopolitical articles to this site, John is a bestselling author in his own right. His international thrillers have appeared on the USA Today and Amazon bestseller lists.