There’s no hiding it: we’ve lived through a very tough and turbulent 2020 and 2021.

The editors at the Collins English Dictionary agreed, and they declared ‘lockdown’ to be the most important word of 2020.

And why not? It sums up the shared anxiety of billions of people, cutting across national and cultural boundaries.

Under lockdown, we’ve experienced tension, tears, debate. The full roller-coaster of human emotions.

Throughout it all, one thing became quite clear to me. For the first time, we may well be living at a point in history where there’s no mainstream agreement about, well, anything.

Source: The Journal of Public Space

Here is a sample of the controversies that gripped us back in 2020:

- Donald Trump was regarded as either the saviour of American values or a tyrant like the Roman emperor Caligula

- Joe Biden was regarded as either the sinister personification of the Deep State or the benevolent reprise of Obama 2.0

- New Zealand’s decision to go into Covid lockdown was considered very smart or very stupid

- Sweden’s decision not to go into Covid lockdown was considered very smart or very stupid

- The population was split over the necessity and effectiveness of social-distancing, mask-wearing, and contact-tracing

- Even though we now have Covid vaccines available, a significant number of the population distrusts immunisation and do not wish to be inoculated

Indeed, the rhetoric has become increasingly divisive.

Conservatives appear to be fixated on conspiracy theories, while the liberals appear to be fixated on cancel and call-out culture.

Just as the room for physical space has shrunk dramatically under Covid, so has the scope for public conversation and compromise.

Views have hardened. Attitudes have become entrenched. There appears to be no middle ground anymore.

Is this development something new? Something sudden? Or is it actually something we should have seen coming?

Future imperfect

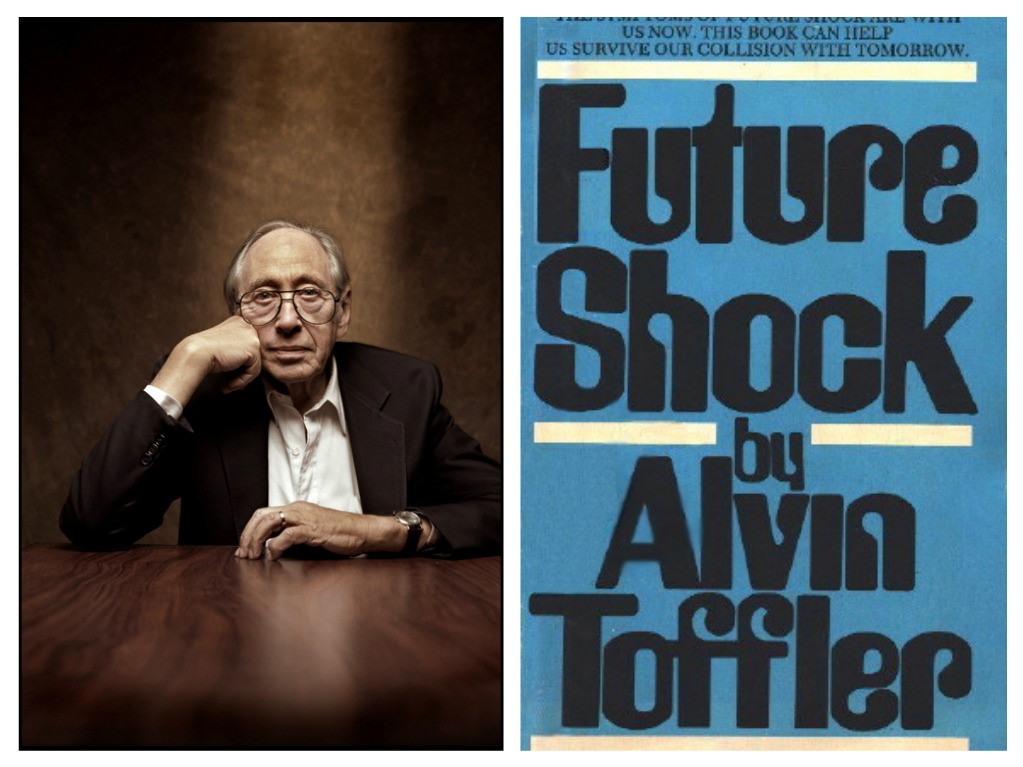

Alvin Toffler may well be the most brilliant thinker you’ve never heard of. He was so brilliant that he staked his reputation on being a ‘futurist’ — someone who sketched out the possibilities of the future.

In 1970, Toffler published a landmark book called Future Shock. The theme he explored was a striking one, and he defined it as the trauma of transitioning from an industrial society to a post-industrial society.

Toffler summed it up like this: ‘Too much change in too short a period of time.’

Source: The Times of Israel

Here’s a sample of Toffler’s predictions, which have all proven eerily prescient:

- Products become disposable because it’s easier and cheaper to replace rather than repair

- Entire sectors of the economy rise and fall with alarming regularity, which hits lower-skilled workers the hardest, forcing them to become nomads in an industrial wasteland

- Human relationships become shallow and superficial as people change homes and friends all the time

- Nothing is permanent anymore, and a transient culture is the rule of the day

Where do we go from here?

Alvin Toffler passed away in June 2016. So he did not live quite long enough to see the upheaval of 2020.

But what if he had? What would he have made of Covid? How would he have interpreted the social spasms that the pandemic left in its wake?

- My guess is that Toffler would have identified Covid as being the ‘future shock’ event that accelerated the painful changes already happening in our society

- He might have recognised the political ideology coming from both liberals and conservatives as being opposite sides of the same coin

- It’s an attempt to offer emotional comfort and provide an explanation for the collective trauma of people experiencing too much disruption in too short a period of time

- But is it really adequate and enough?

For example, consider the airline pilots who have been displaced because of Covid. Seemingly overnight, their long and cherished careers have been pushed into irrelevance. They are now being forced to switch to new roles as Uber drivers or real-estate agents, even as they contend with the anguish of a disruption they did not expect.

Also, spare a thought for the younger generation. They’re now graduating with diplomas and degrees that may already be outdated, venturing into a job market that’s far more fluid and volatile than ever before. It’s a bewildering experience.

Throughout the world, it’s pretty much the same story. Economic hardship. Psychological distress. People still struggling to define and redefine what this new normal looks like.

But is it all bad? Is it all gloomy?

For those of us who survived 2020 and 2021, we might find hope in 2022. There could be renewal and reconciliation. Light at the end of a dark tunnel.

Humanity is, if nothing else, resilient and adaptable. And we are already coming to terms with this new reality — and finding positive baby steps forward.

The world hasn’t ended. Not yet. It’s just in the midst of another transformation. The next page of history is being written right now, and the ride could be bumpy. But the final destination might just be worth it.

Opportunities for 2022

In this time of post-industrial disruption and upheaval, we’re already seeing remarkable opportunities emerge to preserve and grow wealth.

It’s taken us a lot of time and research — but we’ve identified several life-changing trends that could be critical for our financial future.

Property. Infrastructure. Mining. Energy. Food. These are the hidden opportunities the mainstream media aren’t necessarily talking about.

Blink and you might miss it.

We’re revealing the details in our Quantum Wealth Report.

No doubt, we are experiencing a fateful turning point for the stock market.

Embracing this trend requires courage and wisdom — and I believe there’s never been a better time to capture the potential of what’s to come.

Regards,

John Ling

Analyst, Wealth Morning

John is the Chief Investment Officer at Wealth Morning. His responsibilities include trading, client service, and compliance. He is an experienced investor and portfolio manager, trading both on his own account and assisting with high net-worth clients. In addition to contributing financial and geopolitical articles to this site, John is a bestselling author in his own right. His international thrillers have appeared on the USA Today and Amazon bestseller lists.