Atherton, California is one of the richest towns in the world.

Average household income runs at around US$425,000 a year.

More interesting is the portion passive income makes up of that income — approximately $178,000. Residents of this wealthy town earn fully 42% of their income without lifting a finger.

It’s near the tech hub of Silicon Valley, minutes’ drive from Stanford University and Palo Alto. So it’s home to tech wealth and global investors. Yet, the lesson is stark. For the wealthy, active income — income from working — is only part of the equation.

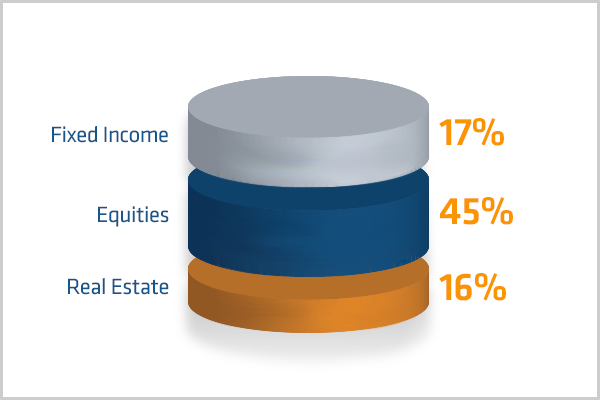

And for America’s millionaires who live in towns like Atherton, 45% of their investable assets are held in equities — stocks and shares like Z Energy (covered in Part One yesterday) — capable of producing passive income (dividends) and capital growth.

How much would I need to invest to retire?

Z Energy is not the highest-paying dividend stock. Among the portfolios I run, I aim for a running yield in excess of 6% per annum.

In my Lifetime Wealth Investor newsletter, we look at many other dividend-paying stocks around the world. Stocks that present the option for income alongside capital growth.

The secret to building yield is growing the capital value. And that means doing your homework. Selecting companies in sectors than could achieve growth while you earn.

If you can retire on $60,000 a year and can achieve a running yield of 6%, you’d need $1 million without eating your capital. If you don’t want to leave your portfolio for your kids, you could eat into the capital sum and enjoy more money each year — or start with less.

Not many investors start with $1 million. But it’s not too hard to reach that level.

The NZX 50 index (comprising the 50 biggest stocks by market capitalisation on the NZ stock market) grew from 5,143 in March 2014 to 9,853 by April 2019.

That reflects growth of around 18% per year. Historically, since the turn of the century NZ stocks show a mean return of about 10.75%.

Now, if you combine dividends with capital growth and could achieve 15% compounding, you’d double your money about every 5 years. The rule of 72 provides a rough calculation on compounding returns. Divide the interest rate into 72 and you get the years needed to double your money.

So, even if you started now with $100,000 and in addition to returns contributed $15,000 per year in savings to your portfolio, it is possible you could reach over $1 million in just 12 years.

Check the compound interest calculator to try different variations.

Of course, the market could also fall and delay your ability to achieve this. The New Zealand market had 91 years of positive returns and 23 years of negative returns between 1899-2012.

All I’m saying for now is if you make passive income your mission and your target, you may be surprised how quickly it builds.

What does a passive income life look like?

I derive my family’s own passive income from two main sources — dividends from our share portfolio and an online education business I started in 2009. I’m working on even more sources.

In the past, I’ve had rental properties. Although, like shares, they’ve delivered capital growth and income, I don’t really count them as passive income. They entail a good deal of physical management work — from meeting tenants, to organising repairs, to ensuring insulation standards are met. And they can get stressful.

Passive income gives you choices. For me, I choose to spend more time with my kids. I choose to do the work I want to do — managing share portfolios for selected eligible and wholesale investors in the same strategy that is successful for me. And writing on these areas of interest here at Wealth Morning.

What will you choose to do once your passive-income plan is in place?

Regards,

Simon Angelo

Editor, WealthMorning.com

PS: Do you want more detailed recommendations on which stocks to select to build your passive income? Join our Lifetime Wealth Investor club today by clicking here…

Simon is the Chief Executive Officer and Publisher at Wealth Morning. He has been investing in the markets since he was 17. He recently spent a couple of years working in the hedge-fund industry in Europe. Before this, he owned an award-winning professional-services business and online-learning company in Auckland for 20 years. He has completed the Certificate in Discretionary Investment Management from the Personal Finance Society (UK), has written a bestselling book, and manages global share portfolios.